are assisted living expenses tax deductible irs

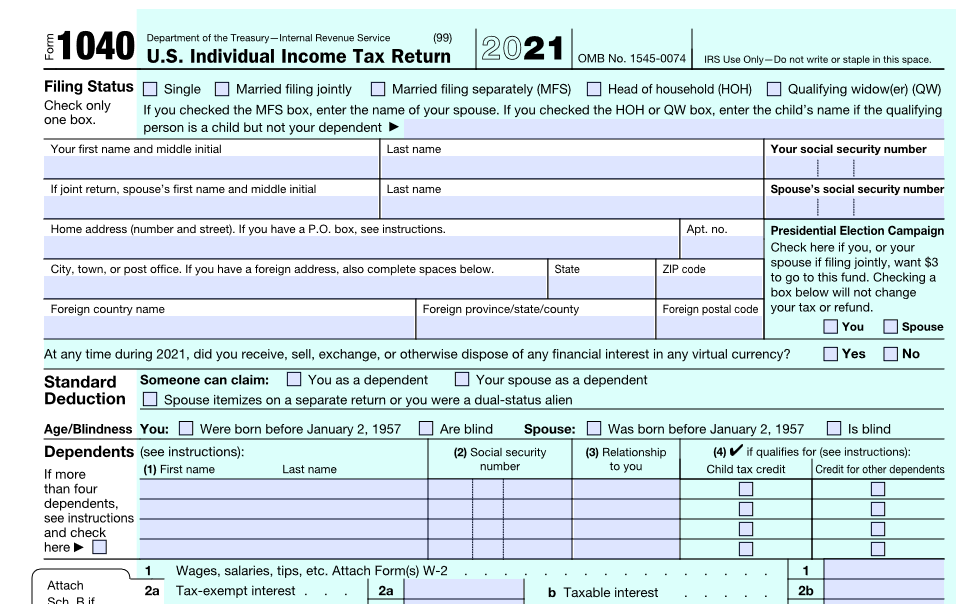

The IRS will have requirements so the family members can assisted living home expenses nursing home expenses and also treatments for Alzheimers disease. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A.

Tax Deductions Caregivers Might Not Know About Agingcare Com

If you your spouse or your dependent is in a nursing home primarily for medical.

. Yes in certain instances nursing home expenses are deductible medical expenses. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. Although you cant deduct general health expenses such as health club dues or vitamins you can deduct many types of professional medical fees.

There are some medical expenses that will comprise a part of the assisted living fees and they will contribute towards a large portion of the residents assistance. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense. Is Assisted Living tax deductible IRS. In this post we will explain the basic factors that determine if assisted living is tax-deductible.

In some circumstances adult children may also get a tax deduction if their parents. TurboTax also notes that assisted living expenses can be tax deductible for individuals needing supervision because of cognitive impairment such as dementia or. Some common assisted living medical.

Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of. In order for assisted living. Children caring for their disabled parents can.

Assisted Living Expenses and Tax Deductions While some families arent aware that they may be entitled to a tax deduction others who do know about it find the process too. IRS Publication 502 allows all medical and dental expenses to be deducted that cost more than 75 percent of adjusted gross income. Deducting Assisted Living Expenses Long-term care services are tax-deductible.

As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. Is Assisted Living Tax Deductible. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia.

Unfortunately many people do not realize that. Howbeit the expenses are not deductible if they are reimbursed by insurance or any other programs. According to the IRS.

According to the Internal Revenue Service IRS taxpayers are allowed to deduct the cost of assisted living partially or in full if you qualify.

Is Assisted Living Tax Deductible Five Star Senior Living

Is Senior Home Care Tax Deductible

Irs Reveals 2022 Long Term Care Tax Deduction Amounts And Hsa Contribution Limits Ltc News

Tax Tip Deducting Medical Expenses Thestreet

Irs Issues Long Term Care Premium Deductibility Limits For 2022 And They Look Pretty Familiar

Financial Solutions Applewood Our House

Can I Deduct Medical Expenses I Paid For My Parent Agingcare Com

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Is Memory Care Tax Deductible A Banyan Residence The Villages

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Irs Issues Long Term Care Premium Deductibility Limits For 2021

Common Health Medical Tax Deductions For Seniors In 2022

Official Irs Rules Of Assisted Living Expenses

Is Assisted Living Tax Deductible What You Can Claim 2019

Income Tax Deadline Is June 15 For Overseas Americans

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Tax Deductibility Of Assisted Living Senior Living Residences